Sephora is set to reimagine the beauty standards with its #SephoraSquad programme

In 2019, Sephora announced a partnership with 24 diverse influencers to create content centered on the brand’s mission.

In 2019, Sephora announced a partnership with 24 diverse influencers to create content centered on the brand’s mission.

The 2022 Most Trusted Brands report revealed the top 10 trusted brands among the US adults based on consumers’ responses about pricing, customer service, and ethical business practices.

A majority of consumers are seeking savoury flavours in their baked goods and snack foods.

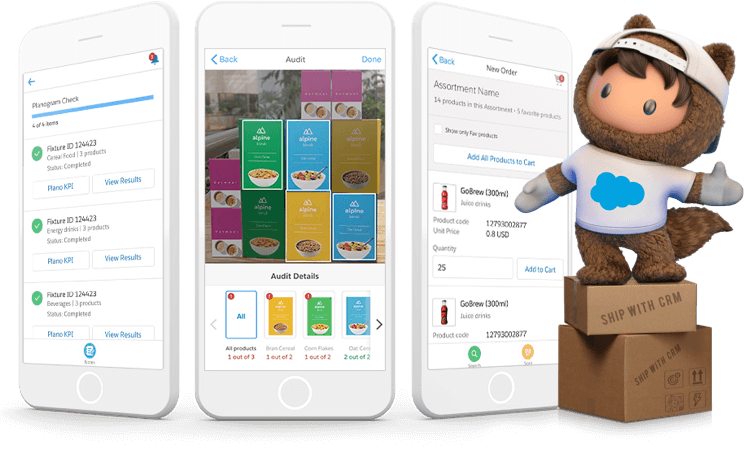

CPG brands are continuously manufacturing innovative products to attract the attention and loyalty of consumers.

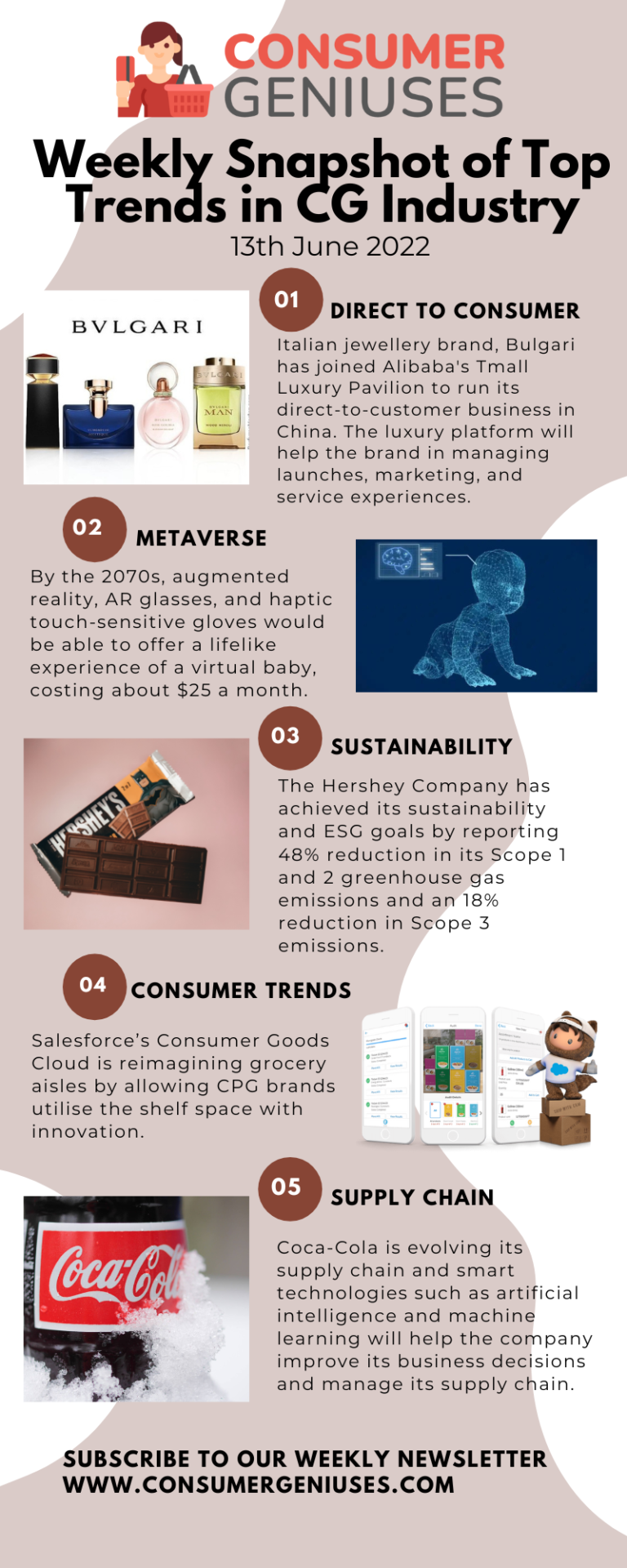

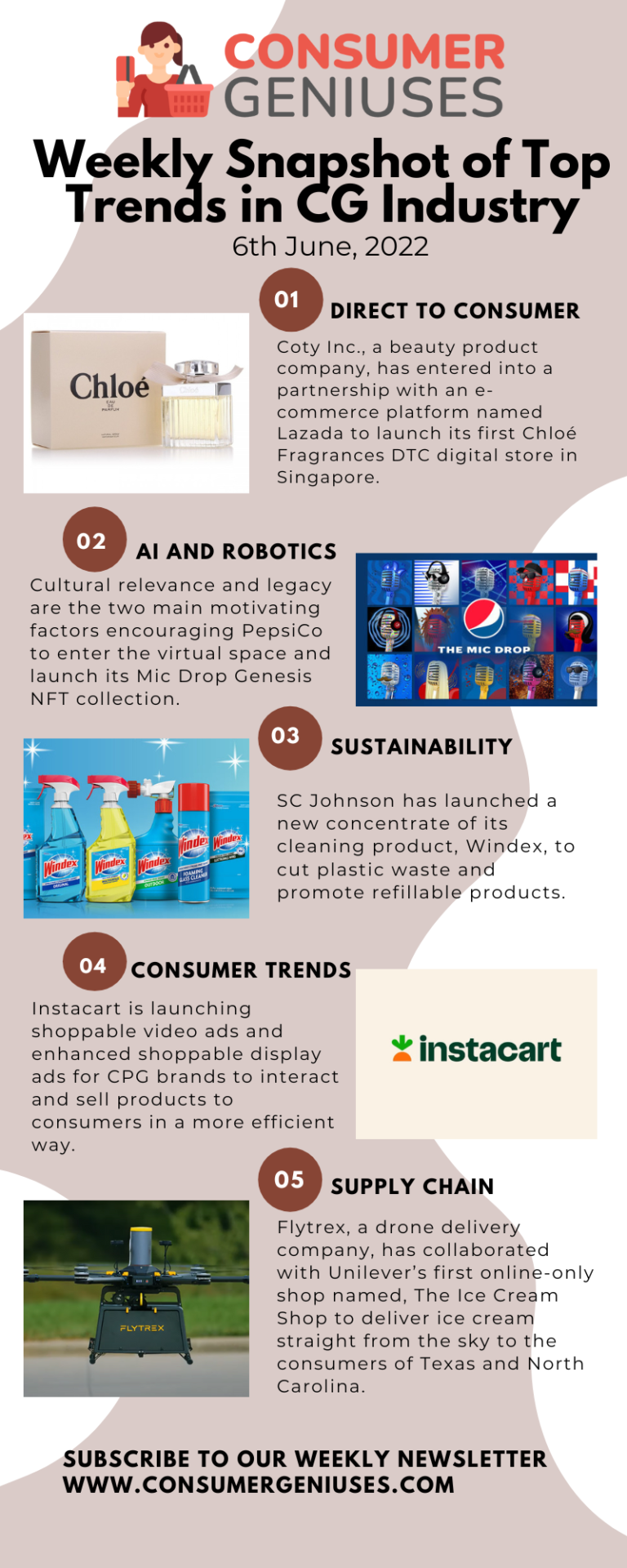

This is the weekly snapshot of top trends from the Consumer Goods industry in the past week (6th June-10th June). We have covered different categories, including:

This is the weekly snapshot of top trends from the Consumer Goods industry in the past week (30th May-3rd June). We have covered different categories, including:

Consumers’ expectations and purchasing habits are changing, with the demand for groceries still remaining on the top.

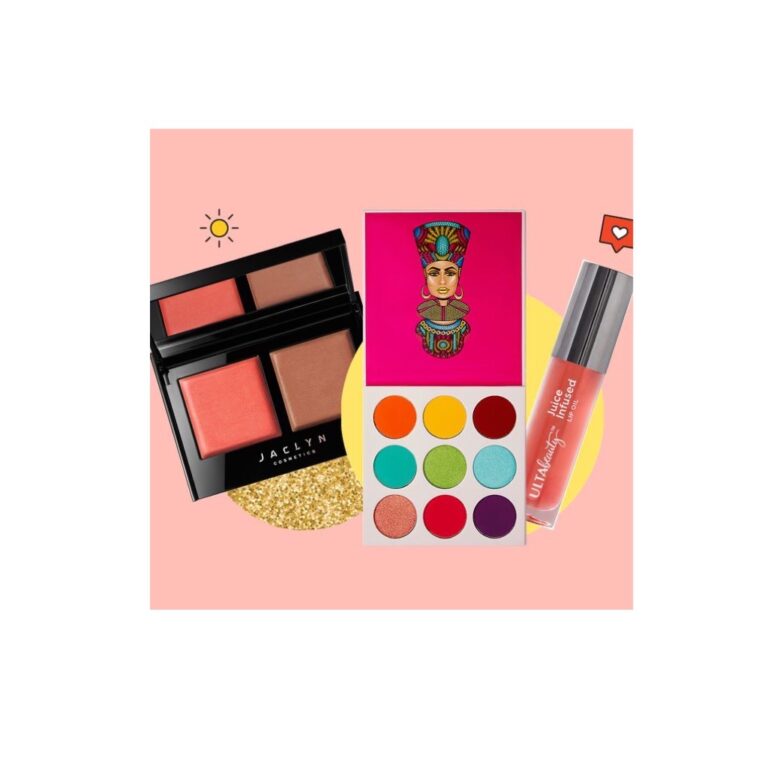

During the pandemic, consumers prioritised buying skincare and healthcare products instead of makeup.

Instacart is launching shoppable video ads and enhanced shoppable display ads to expand its already existing advertising product suite.

P&G adopted the approach of programmatic marketing (use of programmes and software to automate ad management) to support diverse publishers and reach multicultural and racial audiences.

This is the weekly snapshot of top trends from the Consumer Goods industry in the past week (23rd May-27th May). We have covered different categories, including:

Procter & Gamble, an American-based multinational consumer goods corporation, is trusted by millions of households and its brands are passed on to the next generations for over 181 years. P&G has skillfully combined what’s needed with what’s possible to make its consumers’ living rooms, kitchens, bathrooms, and bedrooms more pleasant.

Consumers are now considerate about diversity, equity, and inclusivity (DEI) factors in advertising, which has motivated Target to launch its Roundel Media Fund.

The executives of Mondelēz International, Inc. mentioned during the previous year’s Consumer Analyst Group of New York’s virtual conference that the brand is reimagining its innovation strategy with plans to roll out more impactful and new product lines across the globe.

Todd Kaplan, the chief marketer at PepsiCo plans to take some innovational initiatives to step up the brand’s vision.

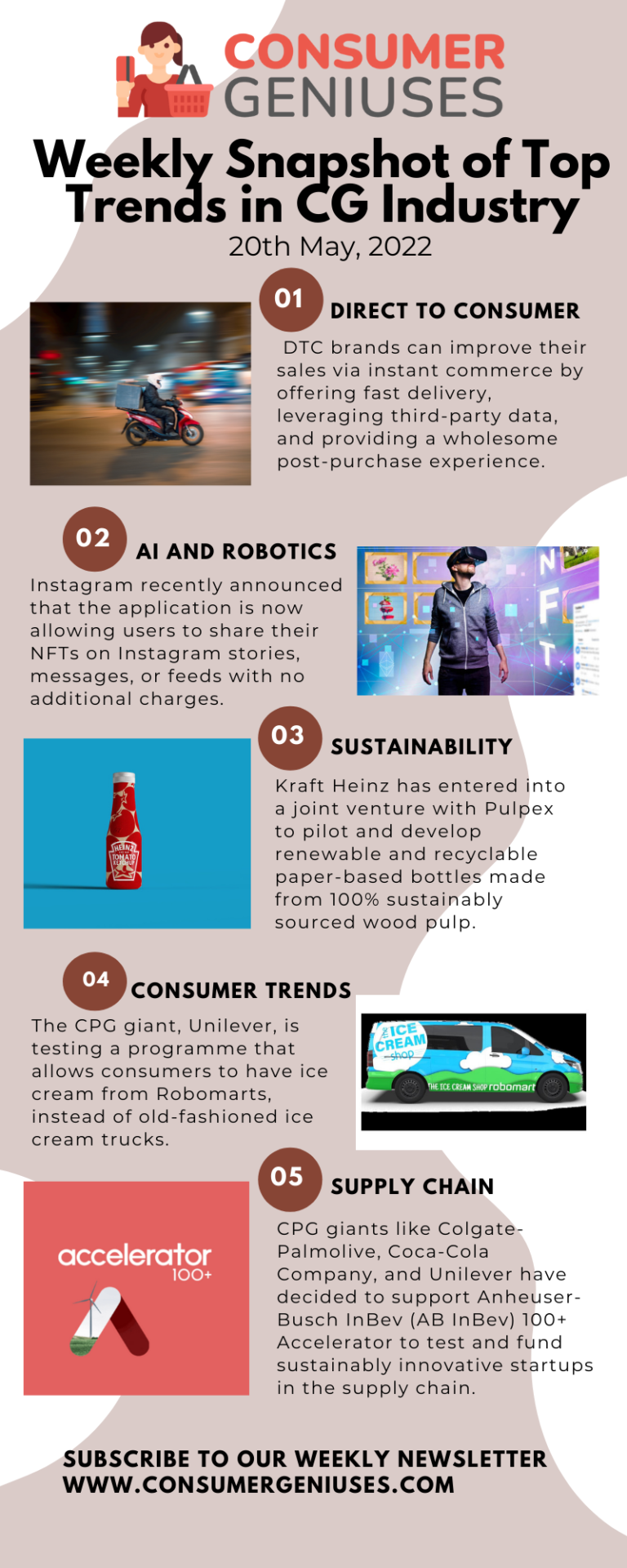

This is the weekly snapshot of top trends from the Consumer Goods industry in the past week (16th May-20th May). We have covered different categories, including:

Tyson Foods achieved unicorn earnings in the second quarter of 2022 and surpassed analysts’ estimations.

In a world full of tech-savvy consumers, Unilever never fails to disappoint its consumers’ expectations.

The Consumer Pulse Survey conducted by McKinsey revealed seven ways in which sentiments and shopping behaviours of consumers across America are evolving. 1, Inflation is unable to stop American consumers from buying goods from the market, they have spent 12% more than they were expected to spend in March 2022. 2, Despite inflation, consumers have spent more on cosmetics, pet food, and sports apparel as compared to experiences like traveling and going to public gatherings. 3, More American consumers are switching to different brands, mainly private-label ones, to spend within budget. 4, US consumers are happily shopping online even after the pandemic and consequently, e-commerce has grown 27% year-over-year in March 2022. 5, Consumers are buying food and nonfood items from both online and physical stores as per their convenience. 6, Although consumers have resumed their outdoor activities, one-third of participating consumers are still conscious of it. 7, ESG factors influence the shopping patterns of US consumers. Read more from McKinsey

Shiseido, a Japanese cosmetic brand, is currently experimenting with its unpaid YouTube series. The brand aims to eventually develop a paid strategic plan that would be implemented in its 24-episode YouTube original series. The VP of integrated marketing strategy and consumer engagement at Shiseido, Jessie Dawes, said that the brand is testing this approach to explore the momentum of videos posted without paid ads. She added that Shiseido would put promotional ads by the end of 2022 so that the ad expenditures can focus on YouTube’s TrueView ad platform and prompt customers to visit Shiseido’s online website. Surprisingly, the company’s efforts are paying off quite well until now. Read more from Glossy

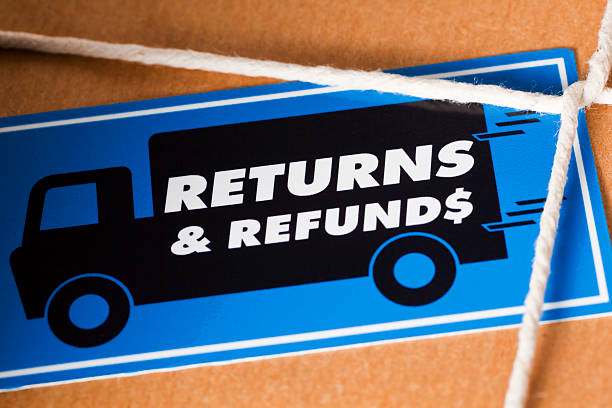

E-commerce has become the new normal since the pandemic but brands need to fix the issue of returns when it comes to online shopping. 71% of consumers report that brands’ websites do not feature a sizing tool, a major reason for returns. MySize surveyed 1,000 individuals from the UK, US, Germany, Italy, and France, and collected their responses. The data revealed that 14% of Italian consumers, 10% of UK and German consumers, and 8% of French consumers often return a parcel. Besides the size issue, another reason for the return is bracketing. 33% of consumers admitted that they buy clothes and shoes in multiple sizes, intending to return the unfit ones. Online retailers and brands can minimise this return rate by introducing sizing tools to their websites. Read more from EcommerceNews

As per the data gathered by Kroger’s subsidiary, 84.51°, sustainability indicators like recyclable packaging or ingredient sourcing are not as important as food wastage. 45% of the shoppers prioritise reducing food waste, while other areas of interest include cutting single-use items and using recyclable shopping bags. Data from 84.51° informs that consumers are more sustainable-conscious in non-food categories like household cleaning 65% and personal care 61%. Within the food category, shelf-stable food and frozen food capture the attention of 61% and 56% of sustainability-conscious consumers, respectively. CPG companies can, therefore, attract consumers across the sustainability spectrum without investing much in packaging or new ingredients by reducing their food waste. Read more from FoodBusinessNews

The UK-based lager brand, Budweiser, has made arrangements to introduce the Ukrainian beer brand, Chernigivske, to British pubs, restaurants, and retailers. Budweiser has positive hopes to raise $5 million from the sales and donate the profit to humanitarian NGOs to help Ukrainian refugees. Anna Rudenko, the marketing director at Chernigivske, said that she is proud of the launch as it is a great initiative to help and support humanitarian relief. Read more from Independent

This is the weekly snapshot of top trends from the Consumer Goods industry in the past week (11th April-18th April). We have covered different categories, including: Direct-to-Consumer: Galderma, a personal skincare brand, reveals that direct feedbacks from retailers, consumers, and dermatologists decide what will be their next innovative product. AI and Robotics: Walmart, Amazon, and Reliance, along with some tech startups (backed up by big investors like Sequoia Capital, Accel, and Tiger Global), are entering into joint ventures with Indian Kirana stores to modernise the traditional store experience. Sustainability: CPG companies are focusing on water conservation to offset their carbon footprint, for example, PepsiCo and Keurig Dr Pepper announced to reduce the amount of wastewater across their operations. Consumer Trends: Kantar Worldpanel presented its study revealing 23 FMCG brands that attracted over 100 million Chinese households, including, P&G, Mengniu, Yili, Vinda, PepsiCo, Coca-Cola, Want Want, Haday, Nice and Unilever. Supply Chain: Pepsico is utilising an AI-empowered solution to improve efficiency and establish digital innovation across its supply chain operations, using 09 Solutions’ integrated business planning platform to perform real-time scenario planning.

Kantar Worldpanel presented its latest study revealing 23 FMCG brands that attracted over 100 million Chinese households. P&G, Mengniu, and Yili attracted more than 170 million households, while Vinda secured the first position with a 9.9% growth in attracting new consumers. Among the 23 brands, PepsiCo, Coca-Cola, Want Want, and Unilever also remained the top performers. In the dairy product industry, Want Want grew its consumers by 4.4% by adding 9.2 million new families. Digital channels played a major role in the growth of FMCG in China, as 93% of Chinese families bought FMCG via online channels. Within e-commerce, the new O2O model (order online and receive delivery from an offline store) helped FMCG companies like Vinda, Haday, Nice, Unilever, and Dali attract new buyers. Read more from KantarWorldPanel

This is the weekly snapshot of top trends from the Consumer Goods industry in the past week (11th April-18th April). We have covered different categories, including: Direct-to-Consumer: Star ratings influence the shopping patterns of online buyers and companies can use this strategy to design better products, satisfy consumers and grow their sale cycle. AI and Robotics: Unilever and Ahold are entering into a joint venture with a retail marketing platform, Perch, to launch a visually interactive end caps lift that can track product engagement via AI and computer vision. Sustainability: Campbell Soup has expanded its wheat sustainability programme, now covering 108,000 acres in Maryland, Pennsylvania, Idaho, and Ohio, according to the company’s 2022 Corporate Responsibility Report. Consumer Trends: Brands like Albertsons and Target are introducing innovative lines, products, and programmes to win customers’ loyalty and are using data to run a personalised and relevant marketing campaign. Supply Chain: Shipium is providing Amazon-like supply chain tech to e-commerce retailers by establishing a tech stack, providing retailers with a supply chain coordination layer that allows them to deliver a shipment at faster and cheaper rates.

According to the research study ”FMCG Market by Type and Distribution Channel: Opportunity Analysis and Industry Forecast, 2018-2025,” the FMCG market size is expected to reach $15,361.8 billion by 2025. Many factors, including, the R&D for the new brands, the trend of online shopping, and the expansion of FMCG in the rural areas of developed companies are resulting in the growth of the FMCG industry. In the recent world scenario, consumers have maintained a hygienic lifestyle, and their shopping patterns depend significantly on hygiene compatibility. This trend has allowed FMCG companies to avail the opportunity and attract consumers by launching products compatible with their lifestyles. Unilever group, Procter & Gamble, PepsiCo, Coca-Cola company, Nestle, and Johnson & Johnson are some of the big names in the FMCG industry. Read more from EinNews

According to the report presented by Kantar Worldpanel, FMCG in China grew by 3% in the first 8 weeks of 2022. The latest government statistics also revealed that the sales of Consumer Goods increased by 6.7%. A famous Chinese hospitality brand, ReceivedGifts, reached 19.2% of the total market valuation, while Yonghui reported a value share of 5.5%. SPAR and Walmart also reported a stable share of 1.7% and 5.1%, respectively, in the Chinese marketplace. Read more from KantarWorldPanel

Big CPG companies and tech platforms are stepping forward and supporting the Ukrainian people. Kellogg donated $1 million to provide food for Ukrainian refugees, while Ikea’s charitable arm, The Ikea Foundation, donated $22 million to provide humanitarian assistance to the refugees. Amazon’s contributions involve donating $5 million to aid organisations like Save the Children and The Red Cross, while FedEx has given $1.5 million in humanitarian aid. Unilever in collaboration with NGOs donated $5.5 million to give food and hygiene products, while the Dove company has launched a Company-Matched Global Employee Giving Program to support Ukraine. L’Oréal has donated $1.1 million through its L’Oréal fund for women, along with 300,000 hygiene products. Read more from ADweek

More and more consumers are choosing private-label products while buying groceries, therefore, brands are introducing innovational lines, products, and programmes to win customers’ loyalty. Last year, Albertsons added 143 new products to its food portfolio, and consumers are going crazy for its Open Nature Cauliflower Crust Pizza. Target’s two brands, Good & Gather and Favorite Day, introduced delicious plant-based items and an indulgent food pantry all under $8 to $1. All of the big grocery giants, including Albertsons and Target, are using data to run a personalised and relevant marketing campaign. Plus private-label brands are striving to roll out more innovational and unique products to earn consumers’ loyalty. Read more from SmartBrief

In 2019, Sephora announced a partnership with 24 diverse influencers to create content centered on the brand’s mission.

The 2022 Most Trusted Brands report revealed the top 10 trusted brands among the US adults based on consumers’ responses about pricing, customer service, and ethical business practices.

A majority of consumers are seeking savoury flavours in their baked goods and snack foods.

CPG brands are continuously manufacturing innovative products to attract the attention and loyalty of consumers.

This is the weekly snapshot of top trends from the Consumer Goods industry in the past week (6th June-10th June). We have covered different categories, including:

This is the weekly snapshot of top trends from the Consumer Goods industry in the past week (30th May-3rd June). We have covered different categories, including:

Consumers’ expectations and purchasing habits are changing, with the demand for groceries still remaining on the top.

During the pandemic, consumers prioritised buying skincare and healthcare products instead of makeup.

Instacart is launching shoppable video ads and enhanced shoppable display ads to expand its already existing advertising product suite.

P&G adopted the approach of programmatic marketing (use of programmes and software to automate ad management) to support diverse publishers and reach multicultural and racial audiences.

This is the weekly snapshot of top trends from the Consumer Goods industry in the past week (23rd May-27th May). We have covered different categories, including:

Procter & Gamble, an American-based multinational consumer goods corporation, is trusted by millions of households and its brands are passed on to the next generations for over 181 years. P&G has skillfully combined what’s needed with what’s possible to make its consumers’ living rooms, kitchens, bathrooms, and bedrooms more pleasant.

Consumers are now considerate about diversity, equity, and inclusivity (DEI) factors in advertising, which has motivated Target to launch its Roundel Media Fund.

The executives of Mondelēz International, Inc. mentioned during the previous year’s Consumer Analyst Group of New York’s virtual conference that the brand is reimagining its innovation strategy with plans to roll out more impactful and new product lines across the globe.

Todd Kaplan, the chief marketer at PepsiCo plans to take some innovational initiatives to step up the brand’s vision.

This is the weekly snapshot of top trends from the Consumer Goods industry in the past week (16th May-20th May). We have covered different categories, including:

Tyson Foods achieved unicorn earnings in the second quarter of 2022 and surpassed analysts’ estimations.

In a world full of tech-savvy consumers, Unilever never fails to disappoint its consumers’ expectations.

The Consumer Pulse Survey conducted by McKinsey revealed seven ways in which sentiments and shopping behaviours of consumers across America are evolving. 1, Inflation is unable to stop American consumers from buying goods from the market, they have spent 12% more than they were expected to spend in March 2022. 2, Despite inflation, consumers have spent more on cosmetics, pet food, and sports apparel as compared to experiences like traveling and going to public gatherings. 3, More American consumers are switching to different brands, mainly private-label ones, to spend within budget. 4, US consumers are happily shopping online even after the pandemic and consequently, e-commerce has grown 27% year-over-year in March 2022. 5, Consumers are buying food and nonfood items from both online and physical stores as per their convenience. 6, Although consumers have resumed their outdoor activities, one-third of participating consumers are still conscious of it. 7, ESG factors influence the shopping patterns of US consumers. Read more from McKinsey

Shiseido, a Japanese cosmetic brand, is currently experimenting with its unpaid YouTube series. The brand aims to eventually develop a paid strategic plan that would be implemented in its 24-episode YouTube original series. The VP of integrated marketing strategy and consumer engagement at Shiseido, Jessie Dawes, said that the brand is testing this approach to explore the momentum of videos posted without paid ads. She added that Shiseido would put promotional ads by the end of 2022 so that the ad expenditures can focus on YouTube’s TrueView ad platform and prompt customers to visit Shiseido’s online website. Surprisingly, the company’s efforts are paying off quite well until now. Read more from Glossy

E-commerce has become the new normal since the pandemic but brands need to fix the issue of returns when it comes to online shopping. 71% of consumers report that brands’ websites do not feature a sizing tool, a major reason for returns. MySize surveyed 1,000 individuals from the UK, US, Germany, Italy, and France, and collected their responses. The data revealed that 14% of Italian consumers, 10% of UK and German consumers, and 8% of French consumers often return a parcel. Besides the size issue, another reason for the return is bracketing. 33% of consumers admitted that they buy clothes and shoes in multiple sizes, intending to return the unfit ones. Online retailers and brands can minimise this return rate by introducing sizing tools to their websites. Read more from EcommerceNews

As per the data gathered by Kroger’s subsidiary, 84.51°, sustainability indicators like recyclable packaging or ingredient sourcing are not as important as food wastage. 45% of the shoppers prioritise reducing food waste, while other areas of interest include cutting single-use items and using recyclable shopping bags. Data from 84.51° informs that consumers are more sustainable-conscious in non-food categories like household cleaning 65% and personal care 61%. Within the food category, shelf-stable food and frozen food capture the attention of 61% and 56% of sustainability-conscious consumers, respectively. CPG companies can, therefore, attract consumers across the sustainability spectrum without investing much in packaging or new ingredients by reducing their food waste. Read more from FoodBusinessNews

The UK-based lager brand, Budweiser, has made arrangements to introduce the Ukrainian beer brand, Chernigivske, to British pubs, restaurants, and retailers. Budweiser has positive hopes to raise $5 million from the sales and donate the profit to humanitarian NGOs to help Ukrainian refugees. Anna Rudenko, the marketing director at Chernigivske, said that she is proud of the launch as it is a great initiative to help and support humanitarian relief. Read more from Independent

This is the weekly snapshot of top trends from the Consumer Goods industry in the past week (11th April-18th April). We have covered different categories, including: Direct-to-Consumer: Galderma, a personal skincare brand, reveals that direct feedbacks from retailers, consumers, and dermatologists decide what will be their next innovative product. AI and Robotics: Walmart, Amazon, and Reliance, along with some tech startups (backed up by big investors like Sequoia Capital, Accel, and Tiger Global), are entering into joint ventures with Indian Kirana stores to modernise the traditional store experience. Sustainability: CPG companies are focusing on water conservation to offset their carbon footprint, for example, PepsiCo and Keurig Dr Pepper announced to reduce the amount of wastewater across their operations. Consumer Trends: Kantar Worldpanel presented its study revealing 23 FMCG brands that attracted over 100 million Chinese households, including, P&G, Mengniu, Yili, Vinda, PepsiCo, Coca-Cola, Want Want, Haday, Nice and Unilever. Supply Chain: Pepsico is utilising an AI-empowered solution to improve efficiency and establish digital innovation across its supply chain operations, using 09 Solutions’ integrated business planning platform to perform real-time scenario planning.

Kantar Worldpanel presented its latest study revealing 23 FMCG brands that attracted over 100 million Chinese households. P&G, Mengniu, and Yili attracted more than 170 million households, while Vinda secured the first position with a 9.9% growth in attracting new consumers. Among the 23 brands, PepsiCo, Coca-Cola, Want Want, and Unilever also remained the top performers. In the dairy product industry, Want Want grew its consumers by 4.4% by adding 9.2 million new families. Digital channels played a major role in the growth of FMCG in China, as 93% of Chinese families bought FMCG via online channels. Within e-commerce, the new O2O model (order online and receive delivery from an offline store) helped FMCG companies like Vinda, Haday, Nice, Unilever, and Dali attract new buyers. Read more from KantarWorldPanel

This is the weekly snapshot of top trends from the Consumer Goods industry in the past week (11th April-18th April). We have covered different categories, including: Direct-to-Consumer: Star ratings influence the shopping patterns of online buyers and companies can use this strategy to design better products, satisfy consumers and grow their sale cycle. AI and Robotics: Unilever and Ahold are entering into a joint venture with a retail marketing platform, Perch, to launch a visually interactive end caps lift that can track product engagement via AI and computer vision. Sustainability: Campbell Soup has expanded its wheat sustainability programme, now covering 108,000 acres in Maryland, Pennsylvania, Idaho, and Ohio, according to the company’s 2022 Corporate Responsibility Report. Consumer Trends: Brands like Albertsons and Target are introducing innovative lines, products, and programmes to win customers’ loyalty and are using data to run a personalised and relevant marketing campaign. Supply Chain: Shipium is providing Amazon-like supply chain tech to e-commerce retailers by establishing a tech stack, providing retailers with a supply chain coordination layer that allows them to deliver a shipment at faster and cheaper rates.

According to the research study ”FMCG Market by Type and Distribution Channel: Opportunity Analysis and Industry Forecast, 2018-2025,” the FMCG market size is expected to reach $15,361.8 billion by 2025. Many factors, including, the R&D for the new brands, the trend of online shopping, and the expansion of FMCG in the rural areas of developed companies are resulting in the growth of the FMCG industry. In the recent world scenario, consumers have maintained a hygienic lifestyle, and their shopping patterns depend significantly on hygiene compatibility. This trend has allowed FMCG companies to avail the opportunity and attract consumers by launching products compatible with their lifestyles. Unilever group, Procter & Gamble, PepsiCo, Coca-Cola company, Nestle, and Johnson & Johnson are some of the big names in the FMCG industry. Read more from EinNews

According to the report presented by Kantar Worldpanel, FMCG in China grew by 3% in the first 8 weeks of 2022. The latest government statistics also revealed that the sales of Consumer Goods increased by 6.7%. A famous Chinese hospitality brand, ReceivedGifts, reached 19.2% of the total market valuation, while Yonghui reported a value share of 5.5%. SPAR and Walmart also reported a stable share of 1.7% and 5.1%, respectively, in the Chinese marketplace. Read more from KantarWorldPanel

Big CPG companies and tech platforms are stepping forward and supporting the Ukrainian people. Kellogg donated $1 million to provide food for Ukrainian refugees, while Ikea’s charitable arm, The Ikea Foundation, donated $22 million to provide humanitarian assistance to the refugees. Amazon’s contributions involve donating $5 million to aid organisations like Save the Children and The Red Cross, while FedEx has given $1.5 million in humanitarian aid. Unilever in collaboration with NGOs donated $5.5 million to give food and hygiene products, while the Dove company has launched a Company-Matched Global Employee Giving Program to support Ukraine. L’Oréal has donated $1.1 million through its L’Oréal fund for women, along with 300,000 hygiene products. Read more from ADweek

More and more consumers are choosing private-label products while buying groceries, therefore, brands are introducing innovational lines, products, and programmes to win customers’ loyalty. Last year, Albertsons added 143 new products to its food portfolio, and consumers are going crazy for its Open Nature Cauliflower Crust Pizza. Target’s two brands, Good & Gather and Favorite Day, introduced delicious plant-based items and an indulgent food pantry all under $8 to $1. All of the big grocery giants, including Albertsons and Target, are using data to run a personalised and relevant marketing campaign. Plus private-label brands are striving to roll out more innovational and unique products to earn consumers’ loyalty. Read more from SmartBrief

Consumer Goods industry will surpass $15T globally by 2025. However the old business model of mass distribution is about to become obsolete. Digital Transformation, Millennials and Gen Z effect, Direct to Consumer and Post-Covid World are going to reshape the winning formula for the new era CG industry. Our weekly newsletter covers global innovations and disruptions in CG industry.

ConsumerGeniuses is managed by IndustryGeniuses (A place where industries meet innovation). We are rolling out content platforms for the world’s hottest industries such as Food & Grocery Retail, Consumer Goods and Healthcare. For each of these key industries, we support Tech Startups and Industry Disruptors as they roll out next generation digital initiatives.

IndustryGeniuses team brings practical domain knowledge of working with 300+ tech startups and brands over the past decade.